American International Gemologists

Gemological Laboratory: Field Gemologists, & Field Research Gemologists

Thursday, November 20, 2025

Inside Madagascar’s Sapphire Rush: Can the Indri Survive?

Friday, October 31, 2025

60 Seconds of Sparkle. SCAD’s Jewelry of Idea's, 2025 with Norman Monteau

Thursday, October 2, 2025

Unlock the Secrets of Gem ID with Norman Monteau: a Video Trailer

Thursday, August 7, 2025

The Sword That Changed History: Napoleon's Diamond! The Trailer

Labels:

: American International Gemologists,

Atlanta Gemologist,

Diamond Appraiser,

Famous Gemologist,

Field Gemologist,

Lab Gemologist,

Los Angeles Gemologist,

Los Angeles Jewelry Appraiser,

Norman Monteau

Location:

Monteau Studios, Atlanta, GA 30310, USA

Tuesday, August 5, 2025

Norman Monteau's Sterling Silver Flatware Appraisal Video

Labels:

American International Gemologists,

Atlanta Gemologist,

Famous Gemologist,

Field Gemologist,

Lab Gemologist,

Los Angeles Gemologist,

Los Angeles Jewelry Appraiser,

Norman Monteau,

Sterling Silver Flatware Appraiser

Location:

Monteau Atlanta Studios

Norman Monteau & AIG Appraisal Saving Another Client

Norman Monteau and The Dog That Swallowed Her Ring

Sunday, May 11, 2025

Norman Monteau Unveiling the Secrets of Reed Gold Mine

Tuesday, May 6, 2025

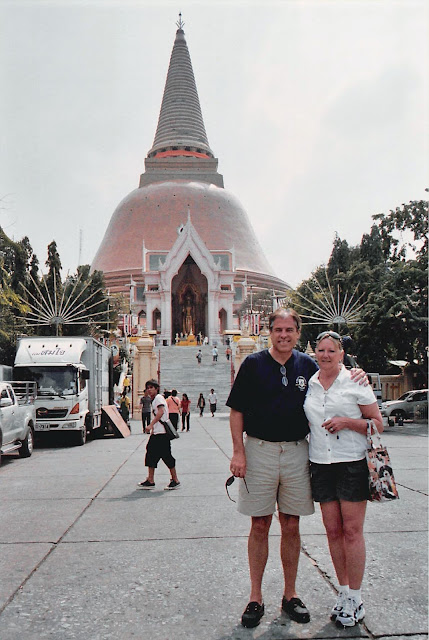

Norman & Sande Monteau in Bangkok after a trip into Cambodia to visit a few of the sapphire mines.

Flashback Friday to September 2006

|

Phra Prathom ChediMueang Nakhon Pathom District, Nakhon Pathom 73000 Thailand

After returning to Bangkok from a field trip to the Pailin Province in Western Cambodia, Sande & Norman Monteau went up to Nakhom Pathom to visit the Phra Prathom Chedi. In the image above we are at the bottom of the North Gate stairs, below the Standing Golden Buddha. You can see the Buddha in the picture.

The stupa is 390 feet high, it is the largest stupa in Thailand, and one of the largest in the world. The chedi was built on the site where Buddhism was introduced into Thailand two thousand years ago.

Nakhom Pathom is located 38 Miles/ 62 KM west of the Chao Phraya river hotels in Bangkok. This can be a day trip from Bangkok. Hire a car and driver for the day to get over there.

Latitude: 13° 49' 6.59" N

Longitude: 100° 03' 22.20" E

|

Friday, April 4, 2025

Trump's Tariff Tsunami: Are Diamonds in Danger?

Subscribe to:

Comments (Atom)